BDSWISS was founded in 2012 as a brand, and it is already a financial group today!And claiming that it provided a series of transaction tools across multiple assets is providing foreign exchange and difference contract investment services for more than one million customers worldwide.

However, this seemingly qualified brokerage brand has a lot of controversy in it!

The reason is that BDSWISS violates the regulatory rules for the difference between the difference in the price of the protection of retail investors. It also conducts misleading promotions to British retail investors. It promises unrealistic returns and has caused huge losses to investors.

In response, Cysec Cysec fined 100,000 euros on the entity of BDSWISSHOLDINGLTD!

I also found it when I understand the details of the incident!As early as 2021, BDSWISS was announced by the FCA of the British Financial Industry Regulatory Administration, and banned the Cyprus broker BDSWISS and all its subsidiaries to provide British investors with a differential contract (CFDS) tool.

Through the punishment regulations, we learned that BDSWISS was controlled by the British FCA, but it has been operating in the UK in violation of regulations after being banned!

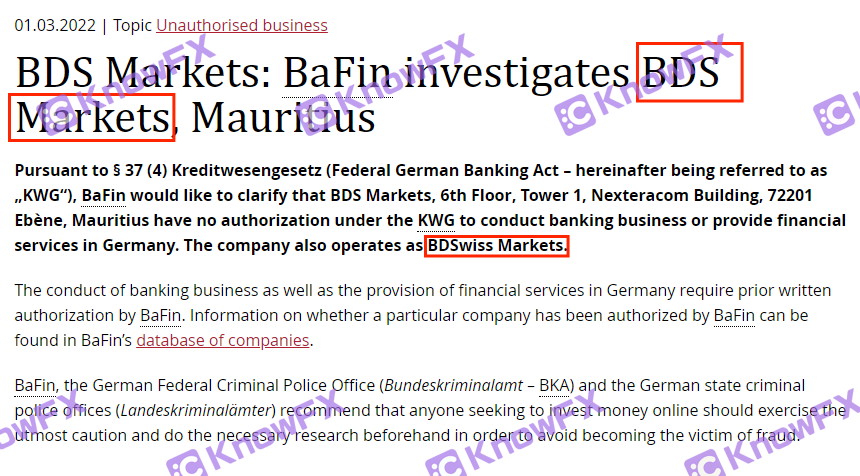

It was investigated and notified by Bafin in Germany in 2022

And there are more than one example of such illegal operations!

In March 2022, the German financial regulatory agency, the Federal Financial Supervision Bureau Bafin, also launched a survey on BDSWISS!According to the Regulations on the 537th (4) of the German Federal Banking Law (KWG), the broker did not authorize the bank business or provides financial services in Germany.

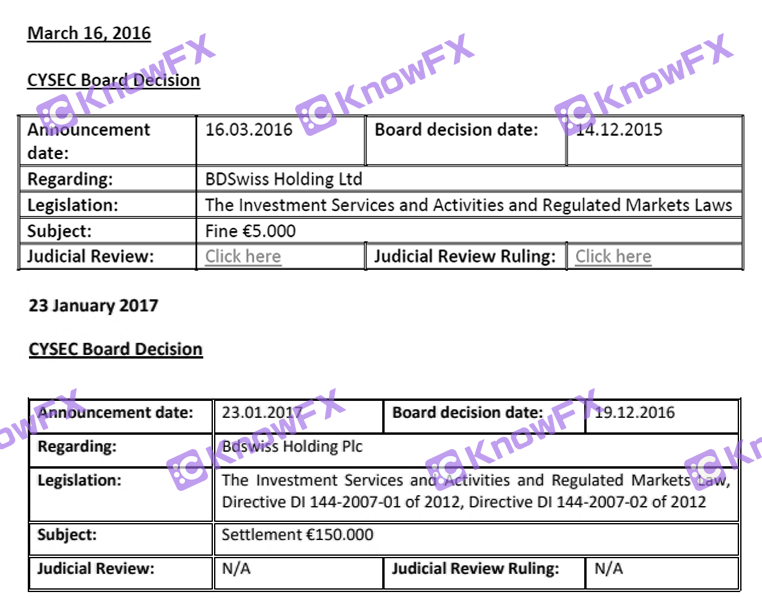

2016 and 2017 were punished by Cysec Cysec in Cyprus

BDSWISS was also revealed in Huiyou's guest complaints. In the two years of 2016 and 2017, it was suspected of violating investment service laws and activities and regulatory market law regulations for protecting customers' interest measures in 2016 and 2017!Cysec was fined 5,000 euros and 150,000 euros, totaling 155,000 euros, respectively, and a total of 155,000 euros.

It can be described as the guest of the regulatory agency!

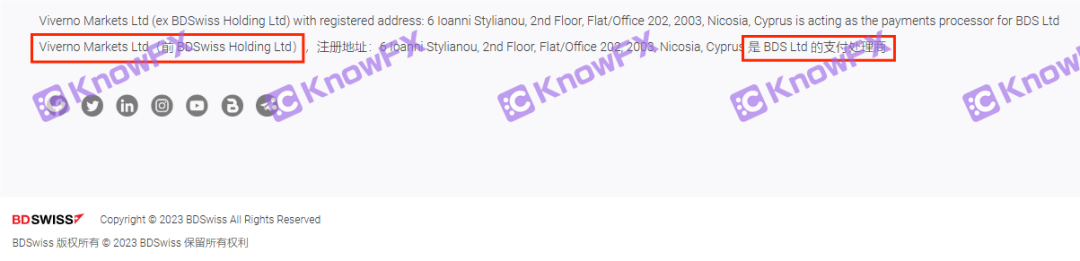

In addition, I know that BDSWISS has been regulated by Cysec, Cyrus, and BDSWISSHOLDINGLTD has suddenly changed its company information after being punished recently!Currently, I continue to hold the license with the new identity of Vivernomarketsltd!

The entity also has its own official website, the domain name "Viverno.com".Knowing Brother learned through the website that Viverno called himself "operating in the financial field's institutional liquidity broker" and "surpassed the traditional broker"!Is this a new brand?BDSWISS runs?

Know that I found a new answer at the end of the BDSWISS official website- "it is a BDSLTD payment processing agency."

So what is the specific of this VIVERNO is very intriguing!However, because it appeared in the public vision for a few months, I did n’t have more information about my brother. I can only wake up the investors who are traded through BDSWISS: Pay attention to whether the channels for getting in and out of money have changed to improve alertness to be alertly alertIn order to avoid unnecessary disputes.

BDSLTD

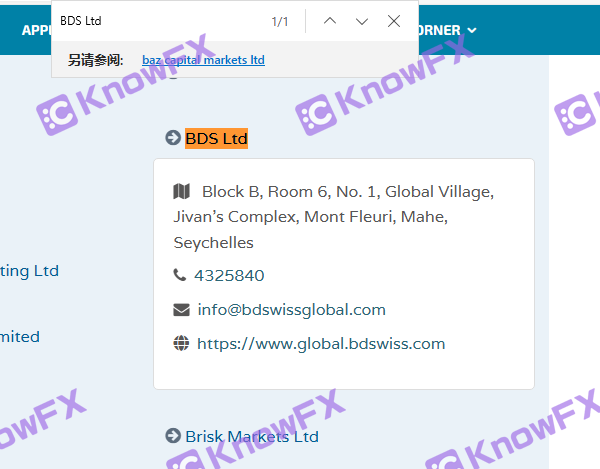

Then look back at the company "BDSLTD"!

BDSLTD is the entity of BDSWISS Financial Group in Seychelles. The SecuritiesDealer license authorized by the Seychel Financial Services Administration FSA is subject to its supervision.

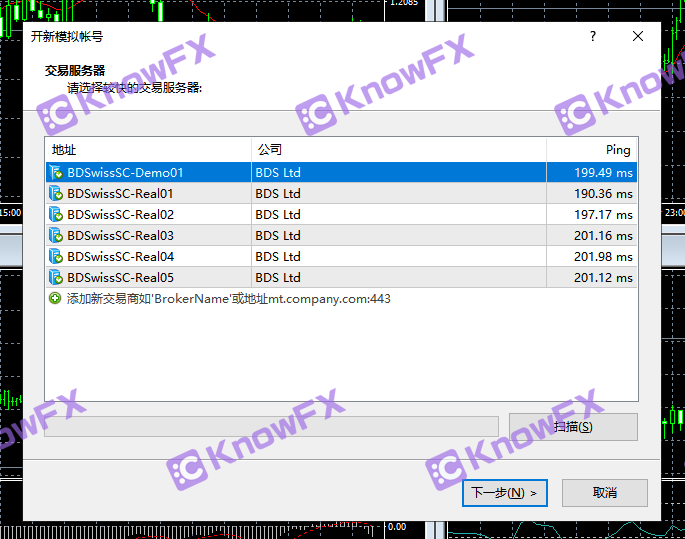

It is worth mentioning that BDSWISS also uses the entity to register the MT4 trading platform, and only uses the BDSLTD entity on the MT4.

The SecuritiesDealer licenses authorized by Seychelles FSA understand that Brother wants to introduce a little, this license is mainly set up to engage in securities transactions!

However, in some cases, foreign exchange transaction derivatives, commodities, and differential contracts CFDS services can also be performed, but this depends on the specific terms of the license and local financial rules.For example, in many jurisdictions, derivatives such as foreign exchange transactions and CFDS are usually regarded as separate service categories, which may require other authorization or licenses.

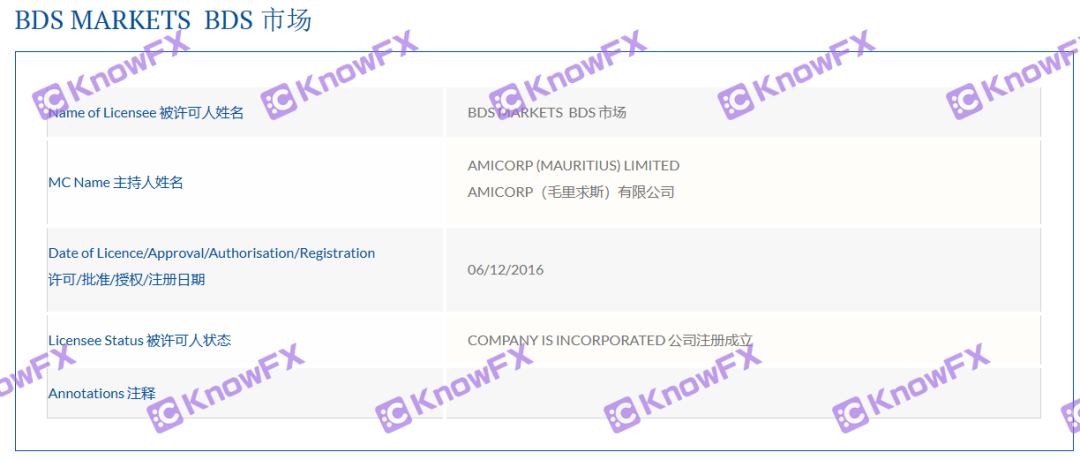

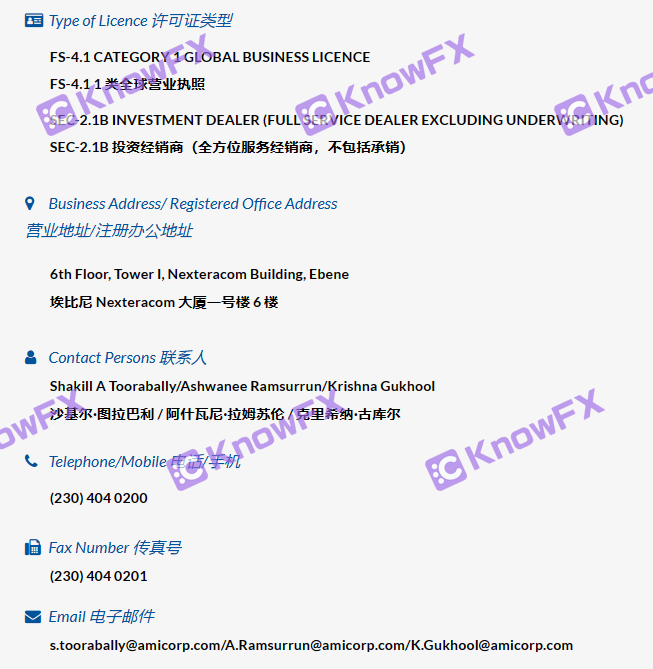

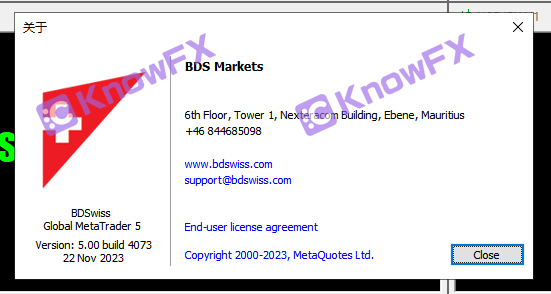

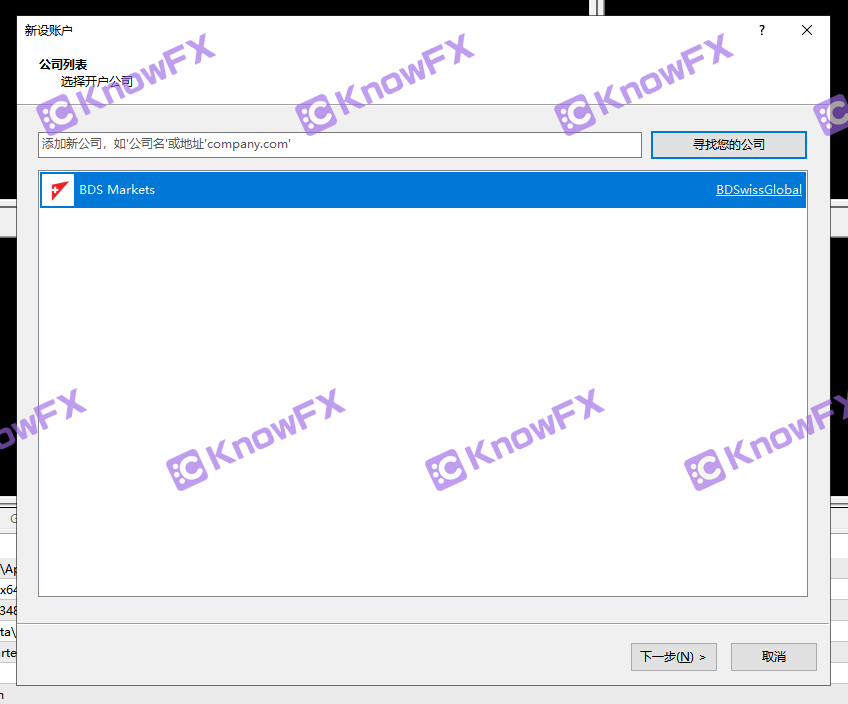

Bdsmarkets

In addition to the company mentioned above, BDSWISS also has a company entity in Mauritius- "BDSMarkets".The company holds the license by the Moiris Financial Services Commission FSC and is supervised.Give two permits to BDSMARKETS:

One: FS-4.1Category1globalBusinesLicence

This is set for registered in Mauritius, but operations are mainly established for overseas market companies.The permission owner was allowed to conduct international trade, investment and other business activities.

Second: SEC-2.1BinVestmentDEALER (FullServicedealeExcludingunderWriting)

This is a license type issued to individuals or companies engaged in investment transactions.InvestmentDealer holding such a license is authorized to engage in securities transactions and related transaction services in Mauritius.

At the same time, BDSMARKETS is used by BDSWISS to register MT5 trading platform, and only uses the entity on the MT5!

Self -developed trading platform

In addition to the use of the two trading platforms of MT4 and MT5, BDSWISS also developed a set of its own trading platforms, and can be deployed on the computer and mobile terminals.

The self -developed trading platform and the "self -developed platform" often talked about the past!Its internal data is not completely controlled by securities firms, but is connected to the MT4 platform!At the same time, BDSWISS also claims that it is completely synchronized with the downloadable version of MT4.This avoids the possibility of "monopoly" platform data on the emergence of securities firms, and reduces concern to use.

Reducing the concerns of use does not mean that there is no concern.The above are just the most basic requirements for a trading platform.The quality of the platform also depends on the performance of the platform's various aspects, as well as stable and effective long -term maintenance.I know that my brother dare not concludes in this regard, so let's prove it!Knowing brother will continue to pay attention.

2000 times lever

Then there is the problem of leverage!BDSWISS dynamic leverage can be pulled to 2000 times!It means that you only need a few margin to control a large amount of assets in order to obtain higher profits in the market.However, please note that trading under high leverage may also bring huge risks.

For this reason, many regulators have limited the leveraged ratio that traders can use to protect the overall risks of traders and markets.I know that I will call for the use of leverage tools.

The above is to understand that my brother has some superficial understanding of BDSWISS, hoping to give Hui friends a certain reference role.thank you for your support!

Finally, if you need to check the platform, disclose clues, and complain, please scan the code to add a detective QQ to make the news!

You need business cooperation, please scan the code and leave the aircraft number to cooperate!

Query platforms, complaints, more information, please download the Hui app

Know brother: 2124228721 Detective: 3464399446

Truth: 3147677259 Poisonous tongue: 2389671330

关于德璞外汇对神探文章的侵权投诉,神探做出如下声明:内容侵犯名誉侵害...

提问:.ICMarkets的中文网站?要懂汇温馨提示:尊敬的用户...

提问:.OpenTrading平台的监管有吗要懂汇温馨提示:尊敬的...

预告!泰国曼谷!FXEXPOAsia2024盛宴!启幕在即!2024...

金投行情漲幅排名最新查詢金融投行是指一種專門從事公司融資、併購、...