Black platform XM deduct investor profit?The self -developed platform avoids supervision, and is divided into high -quality complaints?Jiang has to be old -fashioned!

Detective recently found that Huiyou used a third -party platform score to confirm the security of brokers?

Whether the securities firms are legally compliant and fair and openly open depends on whether the brokerage itself is subject to strict supervision of regulatory agencies with high gold content as a guarantee of fair transactions, and the score is a comprehensive evaluation of multiple aspects of securities firms.

For example, let's look at this XM today.

Detective found that holding the full license to Australia ASIC, the score on the large platform is extremely high, and there is no complaint.But the Internet is full of investors' voices?

And these customers have mentioned a lot of reasons that do not pay gold, almost all of them are: "Do not give gold frozen accounts, maliciously deduct profit!"

We have investigated a lot of illegal behaviors to make hands and feet through the self -developed platform grafting plug -in, or have secretly avoiding supervision, directly deducting customer profitability, and freezing accounts to obtain high margin.Detective can only be said that today, the rapid development of science and technology, the new trading algorithm will continue to contact investors. The road is one foot high and one feet. Investors need to reasonably understand the "game rules" of foreign exchange and securities firms.

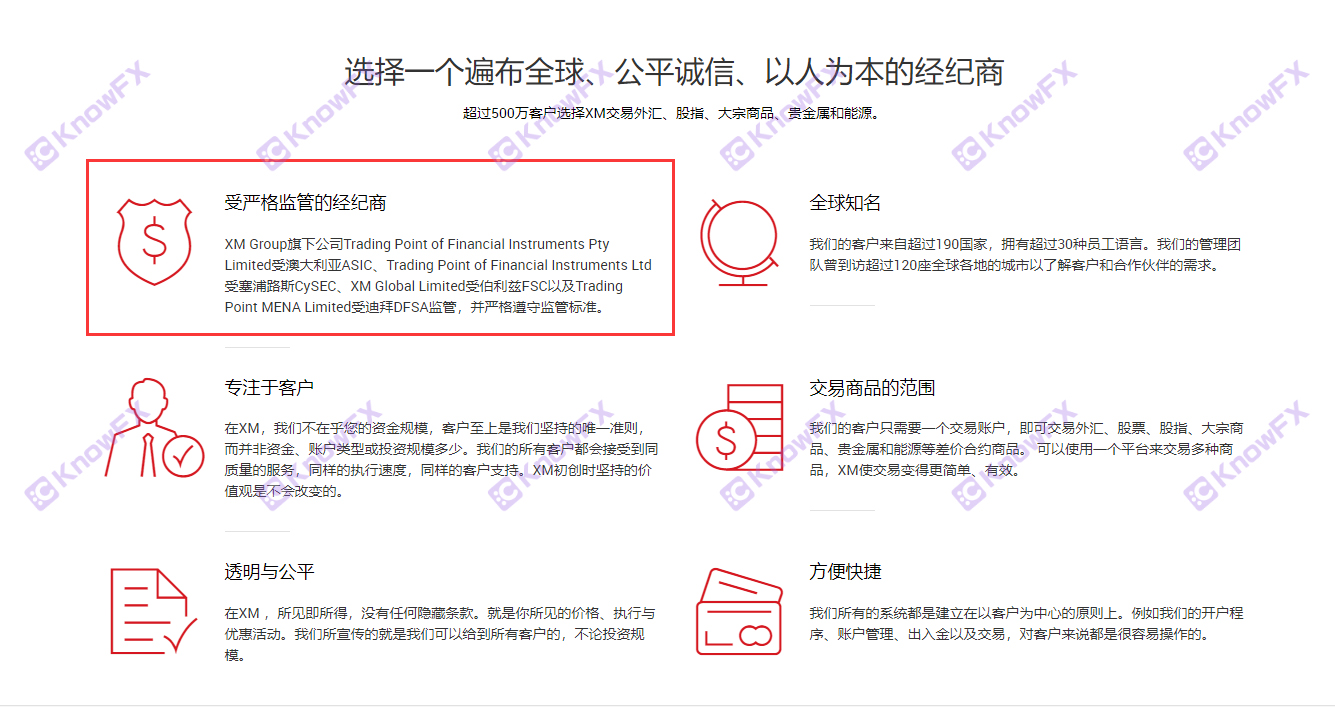

XM's supervision situation

The information displayed on the official website supervision is as follows:

Australia ASIC authorized supervision company: [TradingPointoffinanCialinStruildsptyLimited]

CYSEC authorized supervision company: [TradingpointoffinanCialinStrumentsLtd]]

Belize FSC Authorized Supervision Company: 【XMGLOBALLLITED】

Dubai DFSA Authorized Supervision Company: [TradingpointMenalimited]

There is no doubt that among these supervisors, Australia ASIC and Cyprus CYSEC institution have the highest gold content. First of all, we need to know where the investor's account is opened?

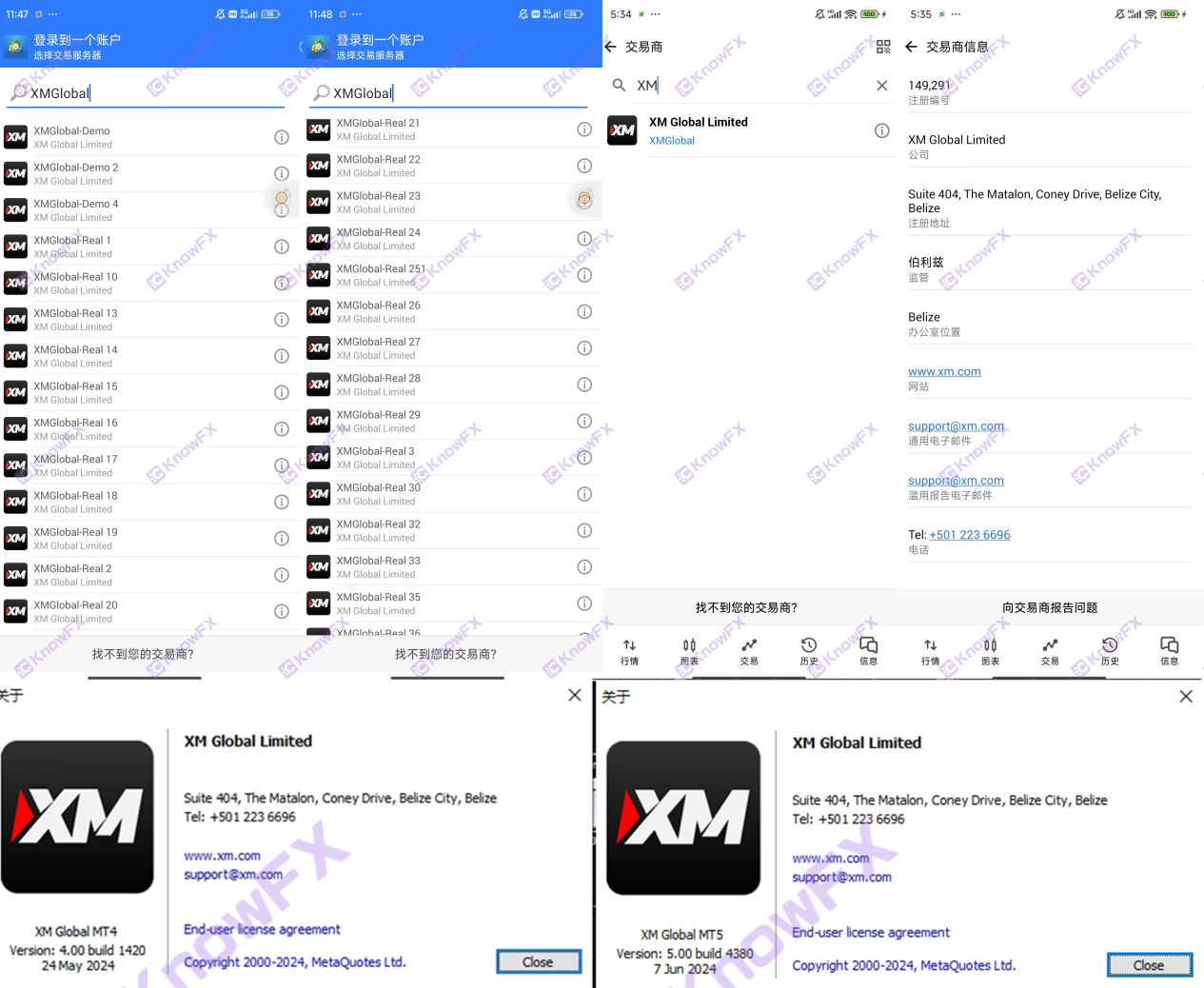

On the "trading platform" column of the XM official website, three transaction platform options were displayed, MT4/MT5 and self -developed platform XMAPP.

MT4/MT5

Detective checked the company on the XM's MT4 and MT5 platforms used to have real transactions with customers. There is only one Britz [XMGLOBALLIMITED].

After inquiries on the official website of Belize FSC, Belize [XMGLOBALLIMITED] was not regulated.

XM obviously holds Australian ASIC licenses, but uses Britz's offshore regulatory license as the only license to trade with investors. This itself proves that XM has distinguished investors and is not ready to trade with investors fairly!

Speaking of the trading platform of XM's official website.

In addition to MT4/MT5, as a third -party platform with public recognition, XM also launched the self -developed trading platform XMAPP.

The risk of self -developed trading platforms is obvious!

Of course it is no problem for me, want to make a profit from me?There is no door.Once the third party supervision is lost, the transaction will no longer be fair, and the fish may miss the less than two. Besides, the real gold and silver "you have to listen to me on my site".Ying's loss, Da Ying title, may even be deleted by trading evidence.

So, the Australian ASIC big -name license, XM will not really prepare "hanging sheep's head to sell dog meat"?

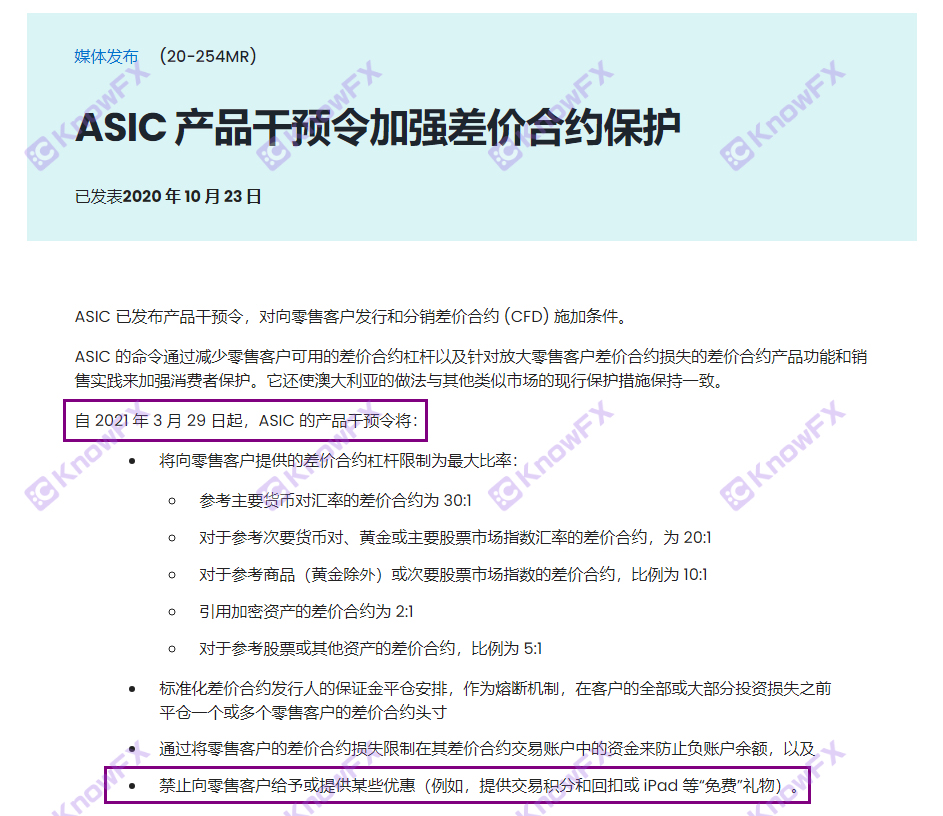

There are special pages to display promotion on the official website of XM, which means that Australian ASIC licenses are completely "vases"!

The Australian ASIC Product Intervention Order Protection of the Enhancement Disclosure Contract has long been banned from providing or provided certain discounts to retail customers (e.g., providing transaction points and rebates or "free" gifts).

At the same time, the regulatory broker will be limited to the maximum ratio of the difference between the difference between the difference in contracts provided by retail customers:

The difference between the exchange rate of the main currency on the exchange rate is 30:10

For the difference between the exchange rate of the secondary currency, the gold or the main stock market index, it is 20: 1

For the difference between the reference goods (except gold) or the secondary stock market index, the ratio is 10:14

Quote the difference between the encryption assets is 2:10

For the difference between the reference stock or other assets, the ratio is 5: 1

The XM completely ignored the regulatory people and did not divide the difference in the contract to the maximum ratio according to the Australian ASIC regulatory requirements!It can prove that XM only obtained the Australian ASIC license to attract investors simply as a bait. On the surface, "we are strictly supervised by Australian ASIC" and never intend to use the ASIC license for transactions!

As for the platform rating mentioned by Huiyou to determine the good or bad of the brokerage firms, the XM platform is typical, with high scores, and the platform can not even query the exposure of relevant customer complaints.In fact, the self -developed trading platform is promoted to drain the investor to the impossible area that can cover the sky. Not only can we harvest leeks, but also avoid supervision and punishment.The magic claws of the offshore supervision company, similar to this method of law, to avoid supervision, the detective suggestions are far away!

If you need to check the platform, disclose clues, complain

Please scan the code to add QQ!

Exchange Circle Detective: 3464399446

You need business cooperation, please scan the code and leave the aircraft number to cooperate!

Query platform, complaints, more information, please understand the coding app to understand the remittance app

Or major application markets and mobile store search

Keyword "To understand" download

关于德璞外汇对神探文章的侵权投诉,神探做出如下声明:内容侵犯名誉侵害...

提问:.ICMarkets的中文网站?要懂汇温馨提示:尊敬的用户...

提问:.OpenTrading平台的监管有吗要懂汇温馨提示:尊敬的...

预告!泰国曼谷!FXEXPOAsia2024盛宴!启幕在即!2024...

金投行情漲幅排名最新查詢金融投行是指一種專門從事公司融資、併購、...