Just yesterday, poisonous tonguejun received a complaint from investors from DLSMarkets.

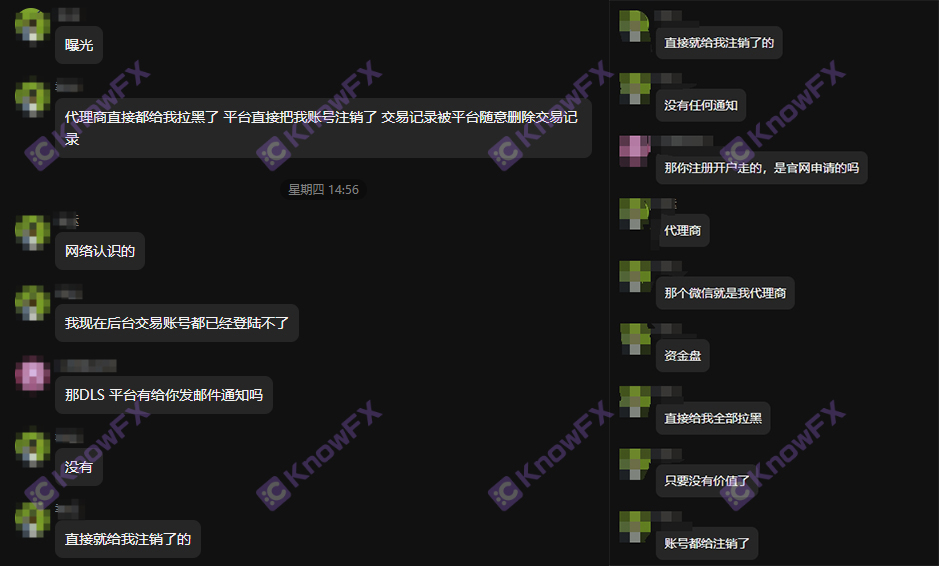

After the investor complained, his account was inexplicably canceled by the DLSMarkets platform. At the same time, the agent also blackly had any contact information of the investor, and completely rolled the investor's funds unilaterally!

The agent of the DLSMarkets platform that investors know on the Internet add WeChat to each other, and then enter the gold DLSMarkets according to the proxy procedures and requirements.

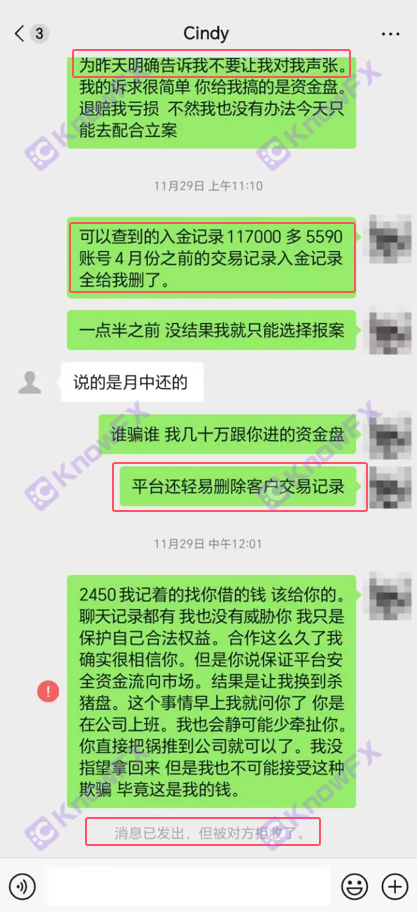

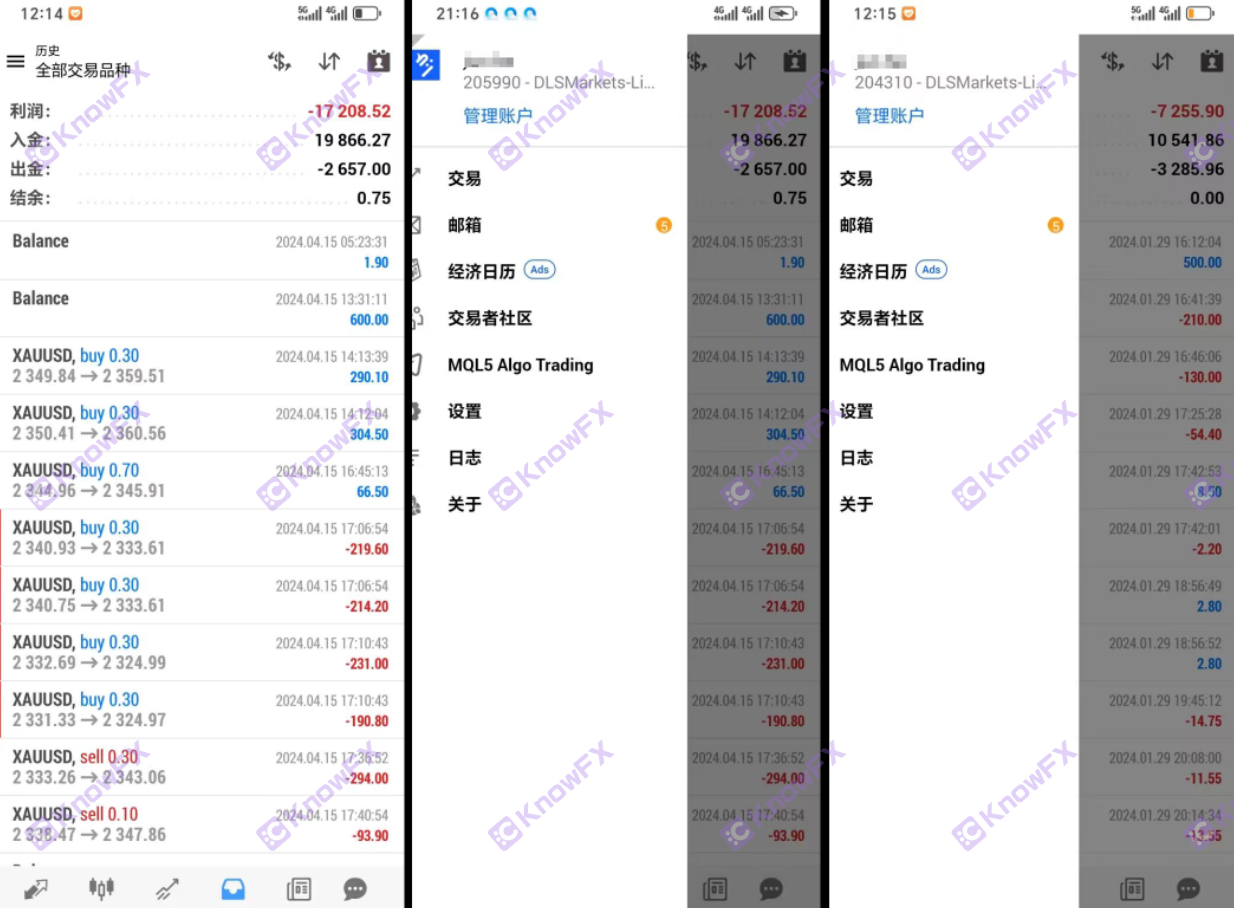

Due to the trust of agents and platforms, the good times did not last long. Investors were questionable to a large number of recent loss transactions. When querying the transaction records, it was unexpectedly found that the transaction record in April was completely deleted and questioned the agent's agent.During the process, the agent asked to "not be able to voiced"?

When investors noticed the fraud immediately reporting the case, the agent quickly pulled the investor, and the platform also deleted the transaction records, and at the same time closed all the investors' trading accounts!

Dlsmarkets

DLSMARKETS is a "old platform" that claims to operate in 15-20 years and obtains Australian ASIC licenses. It is also highly rated on some foreign exchange score software.Human funds are forced to close their accounts, isn't the platform supervised by Australia ASIC?

Official website: https://www.dlas- hrse.com/en

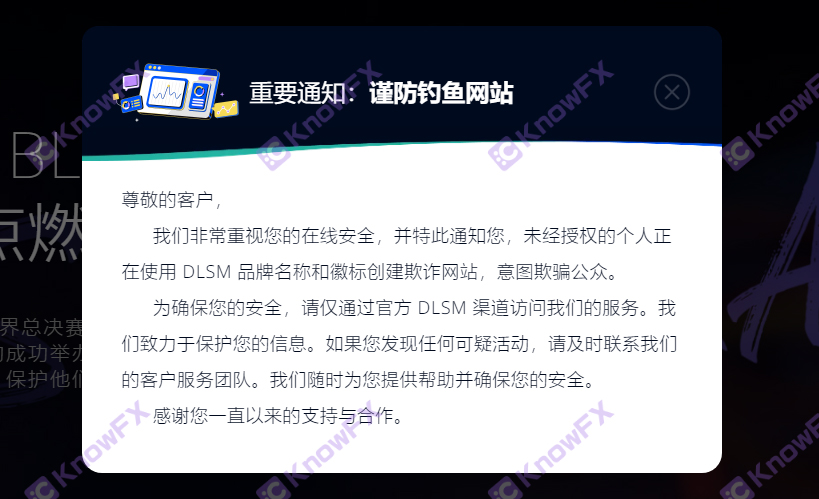

Opening the official website of DLSMarkets will immediately jump out of the pop -up window to warn the fishing website, saying that DLSMarkets has become the disaster area of the fishing network. The pop -up window does not indicate what "official channels" specified on the platform.Can it be regarded as "official channel"?

Assuming that investors stated that the platform harvest is dependent, this pop -up window means that investors' losses and signs in DLSMarkets will the platform directly dump the fish fishing website?

|

|

|

In the navigation bar of DLSMarkets' official website, the third -party trading software currently used by the platform is MT4 and MT5, and the trading software for grafting MT4 developed by self -developed development: DLSMGO.

DLSMARKETS has made large -scale publicity on DLSMGO. You can use high -level trading tools without switching the platform. In shortThe poisonous tongue king was excited when he heard it.

However, it also faces a core issue: even if the platform has a license, the transactions occurred by the self -developed transaction software are not recognized by the global regulatory agency.The reason is not disclosed to the outside world. Whether it is the trading data and the account itself, the platform as a developer has the right to interfere, so the security factor is completely absent.

Since DLSMGO claims to grafted MT4, let's see if the MT4 account opened in DLSMarkets is supervised by the Australian ASIC authority.

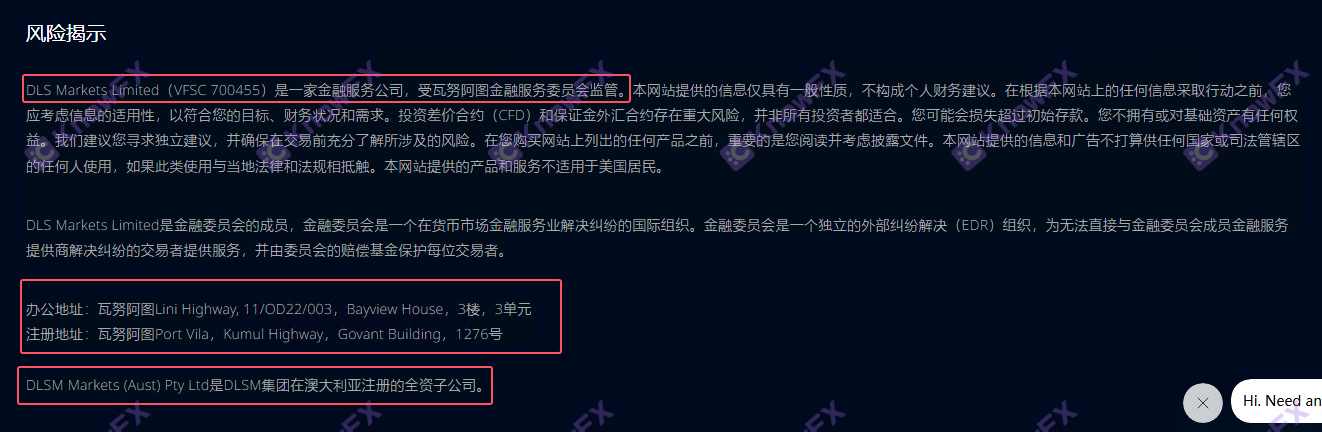

DLSMarkets's MT4 real trading entity name is [DLSMARKETSLIMITED]. It is not Australian company, but a Vanuatu company, and the first company mentioned in the official website risk.

MT5 is also a trading entity, and it is also [DLSMarketsLimited].

You can query the registration and authorization information of [DLSMarketsLimited] on the official website of VFSC. Then it means that the MT4 and MT5s of DLSMarkets use the same Vanuatu company. There are no other regulatory entities, Australian ASIC licenses.It is not used to regulate transactions, just vases.

Vanuatu is a well -known "offshore supervision" financial institution.

The regulatory environment of offshore supervision is loose: may lead to some irregular or high -risk financial institutions that can register and operate here.

Insufficient legal construction: Vanuatu's legal system may not be perfect or perfect, and it is difficult to effectively respond to complex financial cases and disputes.

The international recognition is not high: As a small country, Vanuatu is relatively low in international visibility and recognition.

Regulatory methods and technology are relatively backward: financial regulatory agencies may lack advanced regulatory methods and technologies, and it is difficult to effectively supervise financial institutions, which may cause supervision to fail or lag, and increase financial risks.

The 15-20-year-old brand DLSMarkets, which has the strength of Australia's ASIC license, chose the funds of the self-developed trading platform and the weak regulatory remote island countries.Flow to the island country.Then the accounts mentioned by the complaint investor were suddenly blocked, the transaction evidence was forced to delete, the agent was completely black, the investor's funds were tragically recruited, etc., that is, the final result of weak supervision!Investment risks are high, trading needs to be cautious. Do not blindly believe that strangers can bring "you" to get rich!

Original restricted area, plagiarism, please detour!

Submission and complaints?

Sweep the code directly,

We are your most poisonous ally!

I think "Poisonous Tongue Rating" makes you clap your hands fast?

Don't hide it, one, "watching" is compared to "like"

Let's guard your wallet with a poisonous tongue!

关于德璞外汇对神探文章的侵权投诉,神探做出如下声明:内容侵犯名誉侵害...

提问:.ICMarkets的中文网站?要懂汇温馨提示:尊敬的用户...

提问:.OpenTrading平台的监管有吗要懂汇温馨提示:尊敬的...

预告!泰国曼谷!FXEXPOAsia2024盛宴!启幕在即!2024...

金投行情漲幅排名最新查詢金融投行是指一種專門從事公司融資、併購、...